A little over a week ago, as most of the country was focused on — and generally disgusted by— the spectacle of Washington bumbling its way into and then out of a government shutdown, Congress surreptitiously sneaked $31 billion of tax cuts into the continuing resolution that reopened the federal government.

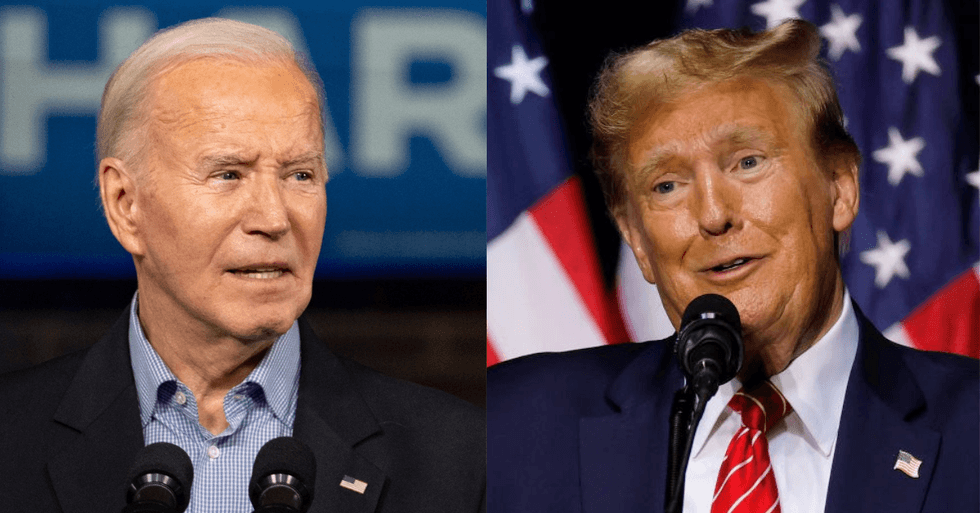

Most of the media’s focus on the three-day shutdown was on Democrats’ demand that Congress vote on legislation to protect 800,000 Deferred Action for Childhood Arrivals recipients, known as “Dreamers,” from deportation. President Donald J. Trump announced in September 2017 that he was canceling the program. Democrats ultimately dropped their demand for a vote on DACA, paving the way for passage of the continuing resolution.

A great deal of attention also was paid to the six-year extension of the Children’s Health Insurance Program (CHIP) contained in the legislation. What did not receive much attention, however, were the three Obamacare taxes and fees that were put on hold: a tax on medical devices, the so-called Cadillac tax on employers who offer very expensive health insurance plans, and a health insurance tax. All three taxes, which were intended to offset the cost of the Affordable Care Act’s expansion of health insurance coverage to low- and middle-income Americans, have been extensively debated by Congress since the ACA became law.

When crafting the legislation to end the shutdown, Republicans took advantage of a legislative loophole that enabled them to include delays in the health insurance taxes without having to worry about opponents being able to block the move.

The delays are not offset by spending cuts or tax increases, meaning that their $31 billion cost gets piled onto to the already fast-rising federal deficit. Fiscal conservatives who are concerned about deficits and the growing U.S. national debt decried the move.

“All the finger pointing has overshadowed the discussion about the actual substance of the budget deal,” Maya MacGuineas, president of the Committee for a Responsible Federal Budget, told the New York Times, “and many lawmakers don’t even seem to care that the deal they are considering — which will almost certainly include even more tax cuts following the unaffordable tax bill Congress just passed, as well as new spending increases — will add tens of billions to the deficit. There is almost zero discussion of the ongoing damage on the nation’s finances.”

The Republican move to delay the health insurance taxes is part of the broader GOP effort to conduct a piecemeal repeal and replacement of Obamacare. Elimination of the individual mandate, which imposed a tax penalty on people who did not purchase health insurance, was a key part of the Republicans’ tax overhaul bill signed into law by Trump in December.

Because Republicans decided to use the budget reconciliation process to revamp tax law, they were limited to $1.5 trillion in revenue losses over a decade. That meant they could not include a complete repeal of the health insurance taxes in the broader tax bill. Instead, they opted to delay their implementation. Delaying the taxes still keeps that portion of the ACA on the books, but the budgetary impact––$31 billion in lost revenue––will be felt immediately.

Federal budget watchers are concerned that the U.S. is well on the way to racking up a $1 trillion deficit this fiscal year. The Congressional Budget Office (CBO) in January said the federal budget deficit rose to $228 billion in just the first three months of the current fiscal year. That’s $18 billion more than the deficit during the same period a year ago. With the Trump tax cuts now kicking in, 2018 government revenue is projected to drop by $135 billion. Also contributing to the deficit are emergency disaster aid bills, totaling $81 billion, to pay for recovery after the California wildfires and Hurricanes Harvey, Irma and Maria.

“When we had trillion-dollar deficits the last time, it was the result of one of the worst economic downturns we’ve seen in history. This will be completely self-inflicted,” said MacGuineas. “When the economy recovered, the deficits came down, not by enough, but this is the result purely of policies, not of a recession.

“Nobody is talking about paying for anything anymore,” she said.

The deal that reopened the government in January only funds operations through February 8. With members from both parties leaving town for retreats to determine legislative priorities for the balance of 2018, that leaves only three working days for them to craft another short-term funding agreement to keep the lights on.

SECONDNEXUS

SECONDNEXUS percolately

percolately georgetakei

georgetakei comicsands

comicsands George's Reads

George's Reads